Myriad Uranium Now Trades on the OTCQB Venture Market and the Frankfurt Stock Exchange

Myriad’s OTCQB symbol is “MYRUF” and Frankfurt symbol is “C3Q”.

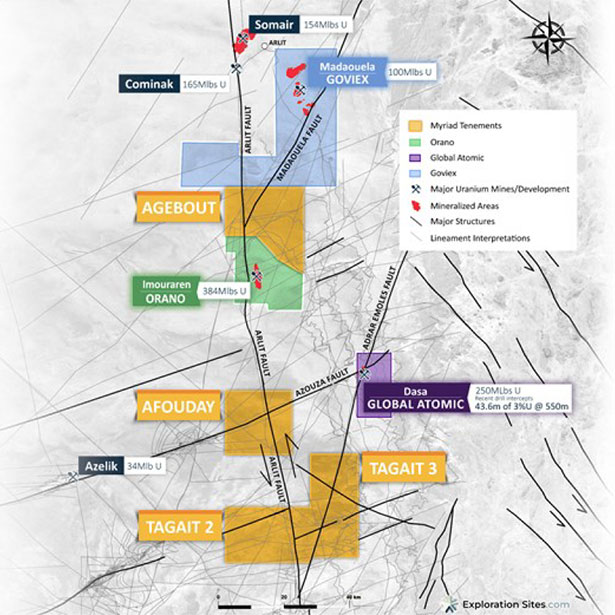

Vancouver, British Columbia–(Newsfile Corp. – March 29, 2023) – MYRIAD URANIUM CORP. (CSE: M) (“Myriad” or the “Company”), a uranium explorer with over 1,800 km² on-structure and adjacent to several of Africa’s most significant uranium deposits, is pleased to announce the listing of its common shares in the United States on the OTCQB® Venture Market (“OTCQB”) under the symbol “MYRUF” and in Germany on the Frankfurt Stock Exchange (“FSE”) under the symbol “C3Q” (ISIN: CA62857Y1097 | WKN: A3D1E0).

Myriad’s common shares continue to trade on the Canadian Securities Exchange (“CSE”) under the symbol “M”.

“Our goal is to be one of the world’s most successful uranium explorers,” Myriad’s CEO Thomas Lamb stated. “By expanding our audience and improving access to our shares, OTCQB and Frankfurt listings will help us get there. We now invite retail and institutional investors around the world to consider investing in Myriad, which holds some of the most prospective uranium ground anywhere.” He then continued, “To take one example, Myriad’s Agebout licence, formerly held by Orano’s predecessor Areva, is just a few kilometres north of Africa’s largest uranium deposit, Imouraren, and on the same structure, the Arlit Fault. Imouraren hosts an eye-watering 384 million pounds of eU O 1. Areva had planned an ambitious drill program for the fault intersection area within our Agebout licence, which we have dubbed “Imouraren North”, but they were not able to initiate it after the Fukushima Daiichi Accident. Now Myriad holds it. This is very exciting in itself. But it gets better. Last week Orano announced a massive in-situ recovery test program at Imouraren. ISR could drastically enhance Imouraren’s economics and bodes extremely well for us right next door on the same fault trend. Another target area we can’t wait to explore is the northeast part of our Afouday licence, which is at the intersection of the Arlit Fault which hosts Imouraren to the north, and the Azouza Fault which hosts Africa’s highest-grade development stage project just to the east. That would be Global Atomic’s 236 million pound Dasa2.”

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/160433_258d625614d519f3_001full.jpg

Company Highlights

- Myriad holds a 100% option interest in over 1,800 km² of prime exploration licences covering the key Arlit, Madaouela, and Azouza fault intersections in the Tim Mersoï Basin, Niger.

- Five world-class uranium deposits are within 40 km of Myriad’s licences, including Africa’s largest uranium deposit, Orano’s Imouraren (384 Mlbs eU O ), and Africa’s highest-grade developmentstage deposit, GLO’s Dasa (236 Mlbs eU O ).

- America’s largest air force base in Africa is located in Tim Mersoï Basin, and Niger has been providing America’s largest utilities with secure and uninterrupted uranium supply since 2007.

- Niger could soon be the world’s 2ⁿᵈ largest uranium producer.

- Areva (now Orano) conducted extensive regional-scale exploration across Myriad’s licences, including 28 km of drilling and high-resolution geophysics. 20% of these holes intersected >100ppm eU O .

- Myriad has Orano’s data worth millions, and their plans for follow-up at key areas.

- Orano just announced in-situ recovery testing at Imouraren. Success could transform its economics and bode extremely well for Myriad’s exploration areas.

- Global Atomic recently announced Athabasca-like intersections at next-door Dasa (0.7m at 13.63% eU O within 43.6m at 3.0%) on the Azouza fault which runs directly into Myriad’s Afouday licence.

- Myriad has deep in-country relationships with Niger’s government, private sector, and Orano.

- Myriad director Fred Bonner, P. Geo, is a recognized leader in environmental stewardship and socially responsible exploration.

- The Company’s exploration plan, to be discussed in upcoming news releases, includes high resolution geophysics and extensive drilling.

Myriad also reports that it has granted its CFO Nelson Lamb 125,000 5-year incentive stock options with a $0.39 strike price.

Myriad’s factsheet is here. A CEO interview with Crux Investor which may be of interest is here. Myriad’s website is myriaduranium.com.

Qualified Person

George van der Walt (MSc. Economic Geology, Pr.Sci.Nat.), a “Qualified Person” for the purpose of National Instrument 43-101, has reviewed and approved the scientific and technical information included in this news release. He has not verified all of the scientific or technical information in this news release respecting historical operations on or adjacent to the property as not all historical information is available.

About Myriad

Myriad Uranium Corp. is a Canadian mineral exploration company with a 100% option interest in over 1,800 km2 of uranium exploration licences in the Tim Mersoı̈ Basin, Niger. Myriad also has a 50% interest in the Millen Mountain Property located in Nova Scotia, Canada, with the other 50% held by Probe Metals Inc. For further information, please refer to the Company’s disclosure record on SEDAR (www.sedar.com), contact the Company by telephone at +1.604.418.2877, or refer to the Company website, at www.myriaduranium.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Thomas Lamb

President and CEO

tlamb@myriaduranium.com

Mineralization hosted on adjacent or nearby properties is not necessarily indicative of mineralization hosted on the Company’s properties. This news release contains “forward-looking information” that is based on the Company’s current expectations, estimates, forecasts and projections. This forwardlooking information includes, among other things, the Company’s business, plans, outlook and business strategy. The words “may”, “would”, “could”, “should”, “will”, “likely”, “expect,” “anticipate,” “intend”, “estimate”, “plan”, “forecast”, “project” and “believe” or other similar words and phrases are intended to identify forward-looking information. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect, including with respect to the Company’s business plans respecting the exploration and development of the Company’s mineral properties, the proposed work program on the Company’s mineral properties and the potential and economic viability of the Company’s mineral properties. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: changes in economic conditions or financial markets; increases in costs; litigation; legislative, environmental and other judicial, regulatory, political and competitive developments; and technological or operational difficulties. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

The CSE has not reviewed, approved or disapproved the contents of this news release.

1 https://www.orano.group/en/nuclear-expertise/orano-s-sites-around-the-world/uranium-mines/niger/mining-sites

2 https://www.sedar.com/search/search_en.htm

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/160433