Copper Mountain, Wyoming, USA

WYOMING - TIER 1 JURISDICTION

Wyoming hosts the largest-known uranium ore reserves in the United States and is now the focus of incoming investment.

- The state also leads the U.S. in uranium production, hosting 4 out of America’s 5 operating uranium mines (2023).

- Wyoming produces 69% of U.S. mined uranium and is highly prospective for large-scale uranium discoveries.

Operating mines and development-stage uranium projects in Wyoming

Operator |

Owner |

Capacity

|

Status |

Lance-Ross |

Peninsula |

3,000,000 |

Operations expected to resume late 2024–2025 |

Lost Creek |

UR-Energy |

2,200,000 |

Resumed commercial operations mid-2023 |

Moore Ranch |

UEC |

3,000,000 |

Not yet constructed |

Nichols Ranch |

Energy Fuels |

2,000,000 |

Standby |

Reno Creek |

UEC |

2,000,000 |

Not yet constructed |

Shirley Basin |

UR-Energy |

2,000,000 |

Not yet constructed |

Smith Ranch-Highland |

Cameco |

5,500,000 |

Standby |

Willow Creek |

UEC |

1,300,000 |

Restart pending final decision in 2024; Ludeman site not yet constructed |

COPPER MOUNTAIN TIMELINE

COPPER MOUNTAIN URANIUM PROJECT

Potentially one of the largest uranium

projects in Wyoming

.

- 2006-2012 – Neutron and Strathmore each held parts of the project area.

- The western part of Canning and certain other areas represented Strathmore’s principal project in 2007, and largely on that basis its market cap rose to C$457m.

- We have unified ownership of the entire Copper Mountain Uranium Project area for the first time since 1982, when Union Pacific held it.

COPPER MOUNTAIN URANIUM PROJECT

UNION PACIFIC PLANNED A LARGE-SCALE

MINE AT COPPER MOUNTAIN

.

- Historical data has revealed that Union Pacific spent US$78m (2024$) exploring Copper Mountain during the 1960s and 1970s.

- Union Pacific drilled more than 2,000 boreholes and discovered 7 uranium deposits and numerous prospects.

- Union Pacific had planned to build a mine, but aborted the plans in 1982 when prices fell.

- Many high grade areas, with intercepts up to 0.385% U3O8 and up to 291 ft.

- Union Pacific estimated a resource of 15-30 Mlbs, and estimated the potential of known deposits and speculated targets at over 65 Mlbs.

- The Copper Mountain Uranium Project contains numerous advanced prospects, exploration targets, and past producing mines that will be thoroughly explored.

COPPER MOUNTAIN URANIUM PROJECT

HISTORICAL EXPLORATION

AND DEVELOPMENT RECORDS

Historical data expected to save significant time and capital

.

- Myriad has acquired extensive historical information, mostly from the 1970s, allowing Myriad to leverage Union Pacific’s large-scale exploration and development work.

- The information includes detailed mapping, surface geochemistry, extensive drill data, historical resource estimates, and project development and mine plans for the Copper Mountain Uranium Project.

- The data is undergoing digitization and thorough validation, and will be incorporated into the geologic model which is expected to save significant time and money on exploration planning as Myriad advances the Project to drilling and an initial resource estimate in Q1 2025.

COPPER MOUNTAIN URANIUM PROJECT

NEW INSIGHTS

Compilation of significant historical intervals confirm high grade eU3O8 near surface

.

- Union Pacific never drilled deeper than 600 ft (182m).

- However, more recent interpretations of the mineralization model suggest that high grade uranium (to 3850 ppm) is most likely concentrated in vertical structures which go much deeper.

- Going deeper represents an exciting opportunity to increase the Project’s uranium grades and volume.

COPPER MOUNTAIN URANIUM PROJECT

HISTORICAL DRILLING

High Grade Zone at North Canning Deposit

.

- Myriad recently announced historical high grade uranium intervals at the Copper Mountain Uranium Project.

- The intervals relate to 82 boreholes drilled into the High Grade Zone at North Canning, an area slated for open-pit mining by Union Pacific.

- The results confirm high grade uranium is relatively close to surface and gives Myriad a clearer path to reevaluating the resources and determining the feasibility of mining.

- New insights from this data could lead to enhanced average grades and volumes in this zone and elsewhere at the Copper Mountain Uranium Project.

COPPER MOUNTAIN URANIUM PROJECT

NORTH CANNING HIGH GRADE ZONE

Intercepts at the High Grade Zone up to 0.385%

.

- Union Pacific had intended the High Grade Zone to be the center of a hub-and-spoke mine they were planning in the late 1970s.

- Intercepts at the High Grade Zone (aka “Area of Special Interest”) were up to 0.385% and included many long mineralized intervals (up to 291 feet).

- Grade-Thickness (GT) products range from the minimum selected 0.3 ft% (equivalent to 0.1% over 3 feet) to 11.55 ft% (represented by 0.05% eU3O8 over 231 feet).

- Within the data set compiled, which related to 82 boreholes, there were 56 intervals >0.1% eU3O8 and 8 intervals >0.2% eU3O8.

COPPER MOUNTAIN URANIUM PROJECT

DISTRICT SCALE POTENTIAL

.

- Background uranium in the granites is 50 ppm.

- Modern techniques and updated geological understanding could lead to new uranium discoveries.

- Union Pacific was focused on developing low-andmedium- grade bulk deposits. Numerous high grade structures have not yet been evaluated.

- The high grade is associated with faults and fractures in the basement granite and amphibolite schists, a feature shared with Beaver Lodge (Athabasca) and other high grade uranium districts globally.

COPPER MOUNTAIN URANIUM PROJECT

POTENTIAL FOR MULTIPLE MAJOR DISCOVERIES

.

- Union Pacific had planned a mine at Copper Mountain but aborted in 1982 as prices fell.

- They evaluated the project as a medium-grade, very large volume deposit and planned open pit mining with a central processing plant. This possibility is open to us.

- Union Pacific identified a number of additional promising targets in the area that did not form part of their resource estimates or mine plan, but instead were slated for follow-up.

- Based on recently acquired historical data the targets include:

Knob Prospect: Could contain up to 500 klbs at 0.15% with significant upside potential.

Midnight: Could contain up to 10 Mlbs.

Bonanza Mine: Produced 780 klbs at 1.3%.

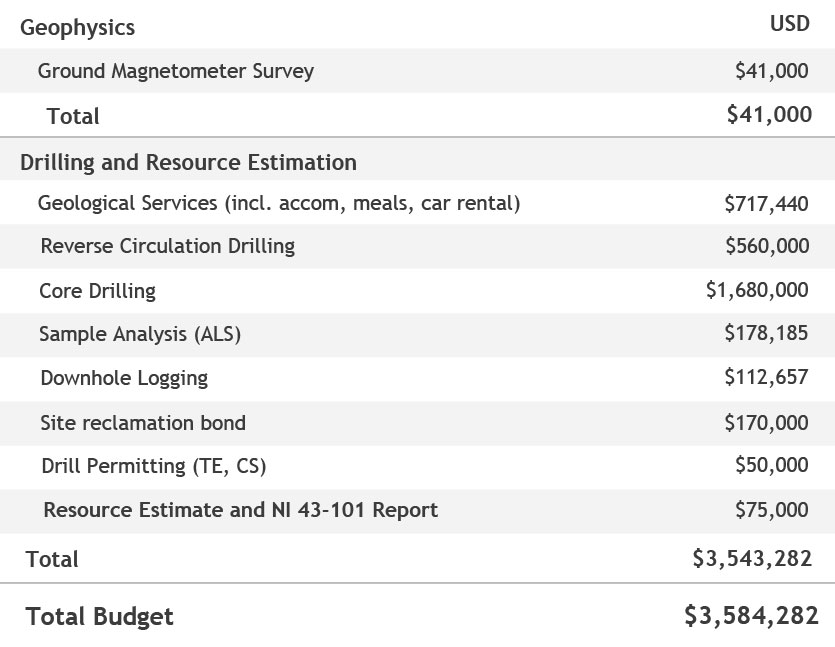

EXPLORATION PLAN

Objective

- Summer and Fall 2024 will focus on drilling the ‘High Grade Zone’ at the Canning Deposit, which was the centre of Union Pacific’s 1979 six-pit mine plan, with the aim of delineating an initial current NI 43-101 resource. Canning contains 10-20 Mlbs according to historic estimates.

- This is the first step toward establishing Copper Mountain as the next major uranium district.

- Subsequent programs in 2025 and beyond, will target additional known historical resources at Fuller, Mint, Allard, Gem and Hesitation, plus high priority prospects such as Midnight (thought by Union Pacific to contain 10Mlbs).

- Total resource potential was reported by Union Pacific to be over 65 Mlbs within or adjacent to known resources, and possibly much higher in the entire Project area.

Copper Mountain 2024 Exploration Plan

MAJOR CATALYSTS

PROPERTY OPTION DETAILS

- Property Option Agreement signed by Myriad Uranium Corp. and Rush Rare Metals Corp. on October 18, 2023, giving Myriad a 75% earnable interest in the Project, subject to an underlying 2.5% NSR royalty.

- A small part of the project (<10% of the total project area) is subject to additional 1% or 3% NSR royalties payable to local ranchers.

- Myriad is required to spend $1.5M before Oct. 18, 2025 to earn 50%, and an additional $4M before Oct. 18, 2027 to earn 75%.

- Switch to 75/25 JV upon completion of spend requirements.

• Upfront payment of $135,000 (paid).

• Upfront share issuance of 575,000 common shares to Rush (issued).

• $150,000 in Myriad shares payable on Oct. 18, 2024, and

• $250,000 in shares payable on Oct. 18, 2025.

- Upon completion of a PEA or PFS, $2,500,000 in Myriad shares to be issued to Rush.

- First C$50 million in net proceeds of production to be shared 50/50 (or equivalent economics).

- Myriad to make a US$25,000 annual payment to original property vendors.

- For more details, see Myriad’s Oct 20, 2023 News Release

HISTORICAL ESTIMATES

Myriad has determined that the historical estimates stated herein are relevant to the Copper Mountain Project area, are reasonably reliable given the authors and circumstances of their preparation, and are suitable for public disclosure. However, readers are cautioned to not place undue reliance on these historical estimates as an indicator of current mineral resources or mineral reserves at the project area.

A qualified person (as defined under NI 43-101) has not done sufficient work to classify any of the historical estimates as current mineral resources or mineral

reserves, and Myriad is not treating the historical estimates as a current mineral resource or mineral reserve as Myriad has not been able to verify all of the data underlying the historical estimates. Also, while the Copper Mountain Project area contains all or most of each potential deposit referred to, some of the resources referred to may sit outside Myriad’s current Copper Mountain Project area.

Furthermore, the estimates are decades old and based on drilling data for which the logs are, as of yet, predominantly unavailable, and there may be other

limitations respecting the historical estimates, including that the nature of the mineralization at Copper Mountain (fracture-hosted) makes estimation from drill data less reliable than other deposit types and that the “delayed fission neutron” factor used in some cases to calculate grades is somewhat controversial, in that the approach is viewed by some experts as too conservative. The historical estimates, therefore, should not be unduly relied upon. See Myriad’s news release dated October 31, 2023 for further information respecting the historical estimates.