MYRIAD URANIUM CORP. ANNOUNCES PROPOSED TRANSACTION RESPECTING COPPER MOUNTAIN PROJECT IN WYOMING, USA

Vancouver, British Columbia–(Newsfile Corp. – September 18, 2023) – Myriad Uranium Corp. (CSE: M) (OTCQB: MYRUF) (FSE: C3Q) (“Myriad” or the “Company“) is pleased to announce that it has signed a binding letter of intent (“LOI”) dated as of today’s date with Rush Rare Metals Corp. (“Rush”) which, subject to due diligence, would give Myriad the option (the “Option”) to earn up to a 75% interest in and to Rush’s Copper Mountain Project (the “Property”), comprised of 110 mineral claims in the State of Wyoming covering approximately 775 hectares. The due diligence period expires 30 days from the date hereof, and the parties are expected to enter a further definitive agreement (the “Agreement”) respecting the Option, under substantially the same terms, on or before that date.

A brief video regarding the transaction and Copper Mountain can be viewed here:

The Copper Mountain Project

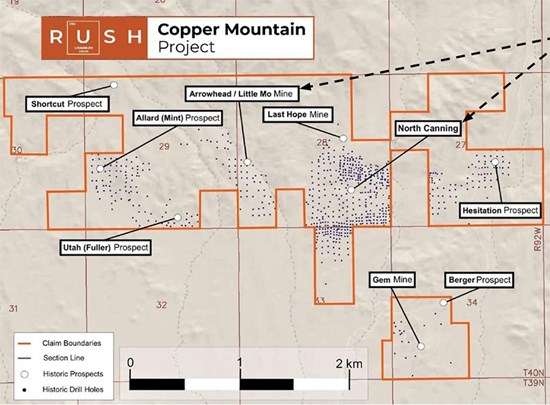

The Property is comprised of 110 claims in the Copper Mountain district of Wyoming, widely regarded as one of the best uranium exploration jurisdictions in the world. Within the Copper Mountain claims area are several known historic zones of uranium mineralization, including the Canning, Hesitation, Mint and Fuller deposits, as well as a historical mine previously known as the Arrowhead Mine, which produced approximately 500,000 pounds of uranium in the 1960’s and 1970’s. Prior to a vast reduction of uranium exploration in the USA throughout the 1980’s, Copper Mountain was the focus of several significant drill programs, and there are estimated to be as many as 2000 historical drill holes in the claim area. Consequently, there is an abundance of historical data, including drill logs, geological reports, maps, resource estimations, and geological team discussion memos, which will all need to be carefully reviewed and analysed. Note some but not all of the historical data has been located, and the research to find any missing data continues.

A map showing the Copper Mountain claim boundaries, known uranium occurrences, and some historical drilling locations is provided below, as well as photographs of the landscape near the Canning Deposit.

Figure 1: Map of the Copper Mountain Project

Figure 2: Picture of Copper Mountain Project

“This will be a transformative transaction for Myriad,” stated Thomas Lamb, Myriad’s CEO. “We already have the potential to make one or even several world-class discoveries next to Africa’s largest and highest-grade uranium deposits. But now, assuming everything goes as planned over the next 30 days, we will be on a trajectory to earn up to 75% of a very strong asset in America’s top uranium jurisdiction, just as the price of uranium is rising fast and the US government is focused on supporting domestic production. Copper Mountain has compelling attributes: it contains the historic Arrowhead mine, which produced 500,000 lbs eU3O8. It contains the Canning Deposit, which previous owners had planned to mine by open cast, even to the point of building a leach pad nearby, prior to the uranium pull-back in the 1980’s. In due course, we look forward to discussing historic resource estimations for Canning, which we can do once historical materials have been properly reviewed and qualified by our QP’s in accordance with market regulations. Copper Mountain has seen up to 2,000 drill holes and we have data for many of them, and we are acquiring more. In addition to the Canning Deposit, which is where most historical holes are concentrated, the project also has numerous other uranium occurrences within the claim area that have not been fully explored and are known to contain higher grades. We are excited about that exploration upside. Copper Mountain ore is highly leachable and may be amenable to in-situ recovery which we will test in the near future. This likely mitigates the shortage of uranium mills in the US. We also benefit immensely from Technical Committee member David Miller’s expertise. Mr. Miller is a leading in-situ recovery expert. His knowledge of the local geology and long career working with Areva and Strathmore Minerals is an invaluable asset for us.”

Thomas Lamb then added, “And there are many macro positives. Wyoming is considered the top uranium mining jurisdiction in the US. Many of the leading near-term producing ISR projects in the United States are located in Wyoming, such as Cameco’s Smith Ranch – Highland, Peninsula Energy’s Lance Project, UR-Energy’s Lost Creek and Energy Fuels’ Nichols Ranch. UEC and enCore Energy also have several ISR projects projects in the state. The state of Wyoming and the local community of Riverton near the Copper Mountain Project both have a strong history of supporting uranium mining. Wyoming senator John Barrasso strongly supports uranium mining in the US and is leading a bill to ban Russian uranium imports.

“Finally, what gives me the most pleasure is that this is the best kind of transaction in that it’s a real win-win. It enables Rush to focus on ramping up exploration on its principal asset, the Boxi rare earth project in Quebec, where channel sampling and other work along its 14 km dyke is returning up to 27% niobium and 12% uranium, while Myriad develops Copper Mountain to the benefit of both companies. Both Myriad and Rush have small market caps and very tight share structures. This gives both companies tremendous upside potential while keeping dilution to a minimum.”

Pete Smith, Rush’s CEO, commented, “this is a highly advantageous arrangement for both companies. Copper Mountain is an outstanding uranium prospect in one of the world’s best uranium jurisdictions. Myriad and its team, including George Van Der Walt and David Miller as technical consultants, are already established as a top uranium exploration group, and they have the resources to advance Copper Mountain immediately. As a past uranium producer and with an abundance of historical information available for further analysis, including up to 2,000 drill holes and numerous historical resource estimations, Copper Mountain has the potential to become a significant global uranium prospect. While maintaining a substantial interest in Copper Mountain, Rush can continue its focus on its Boxi Property in Quebec, which has advanced with significant progress over the past summer. I expect that this deal will result in enhanced shareholder value for both companies going forward.”

The Transaction

Under the LOI and subsequent Agreement, Myriad has the option to acquire an initial 50% interest in the Property by: (1) making an initial cash payment of $100,000 to Rush and issuing 576,209 common shares of Myriad (each, a “Share”) to Rush on the date of execution (the “Effective Date”) of the Agreement; (2) making an additional cash payment of $35,000 to Rush on the date which is 90 days from the Effective Date; (3) issuing an additional $150,000 worth of Shares to Rush on the date which is one year from the Effective Date; (4) issuing an additional $250,000 worth of Shares to Rush on the date which is two years from the Effective Date; and (5) within two years of the Effective Date, making expenditures of no less than $1,500,000 on the Property. On successfully earning a 50% interest in the Property, Myriad will have the option to acquire an additional 25% interest (for a total interest of 75%) in the Property by making additional expenditures of no less than $4,000,000 (for total expenditures of no less than $5,500,000) on the Property within four years of the Effective Date. In addition, upon completion of a Prefeasibility Study or Preliminary Economic Assessment respecting the Property, Myriad shall be obligated to issue an additional $2,500,000 worth of Shares to Rush.

Upon Myriad successfully earning an initial 50% interest in and to the Property, the parties will be deemed to have formed a 50/50 joint venture for the purposes of the continued exploration, development and exploitation of the Property and will negotiate, execute and deliver a joint venture agreement which shall include such terms and conditions normally provided for in commercial transactions of such nature that are mutually acceptable to the parties including without limitation: (i) the operator of the joint venture from time to time; (ii) Myriad’s right to earn an additional 25% interest (for a total interest of 75%) in and to the Property; (iii) Myriad’s potential right to earn an additional 25% interest (for a total interest of 100%) in and to the Property at fair market value; and (iv) a 50/50 split of the initial $50,000,000 in net production proceeds from the Property, or an alternative structure that is economically equivalent, following commencement of commercial production.

Any Shares issued under the Agreement will be subject to a four month hold period under applicable securities laws. The value of any Shares issued under the Agreement following the Effective Date will be the value weighted average trading price of the Shares on the Canadian Securities Exchange (or such other Canadian stock exchange on which the Shares are trading at the applicable time) for the 10 trading days preceding the date on which such Shares are issued.

The proposed transaction is subject to several conditions, including completion of due diligence, execution of the Agreement, and receipt of all necessary regulatory approvals, including approval of the CSE (if applicable). The proposed transaction is an arms-length transaction and does not constitute a fundamental change or result in a change of control of either company, within the meaning of the policies of the CSE. Under the LOI, Myriad and Rush have agreed to proceed diligently and in good faith to negotiate and settle the terms of the Agreement, which are to be substantially the same as indicated in the LOI.

Myriad will provide an update respecting the proposed transaction in due course.

About Myriad Uranium Corp.

Myriad Uranium Corp. is a Canadian mineral exploration company with 80% ownership of over 1,800 km2 of uranium exploration licenses in the Tim Mersoï Basin, Niger, and the option to earn up to 100%. These licenses are surrounded by many of the most significant uranium deposits in Africa, including Orano’s 384 Mlbs eU3O8 Imouraren, Global Atomic’s 236 Mlbs Dasa, and Goviex’s 100 Mlbs Madaouela, and on the same fault structures. Myriad also has a 50% interest in the Millen Mountain Property in Nova Scotia, Canada, with the other 50% held by Probe Metals Inc. For further information, please refer to Myriad’s disclosure record on SEDAR+ (www.sedarplus.ca), contact Myriad by telephone at +1.604.418.2877, or refer to Myriad’s website at www.myriaduranium.com.

A new video relating to this transaction is here. For additional information focused on Myriad’s Niger projects, the Company’s factsheet is here. A CEO interview with Crux Investor which may be of interest is here. A recent detailed interview with Uptrend Finance is here.

Myriad Contacts:

Thomas Lamb

President and Chief Executive Officer

tlamb@myriaduranium.com

Mineralization hosted on adjacent or nearby properties is not necessarily indicative of mineralization hosted on the Company’s properties. This news release contains “forward-looking information” that is based on the Company’s current expectations, estimates, forecasts and projections. This forward-looking information includes, among other things, the Company’s business, plans, outlook and business strategy. The words “may”, “would”, “could”, “should”, “will”, “likely”, “expect,” “anticipate,” “intend”, “estimate”, “plan”, “forecast”, “project” and “believe” or other similar words and phrases are intended to identify forward-looking information. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect, including with respect to the Company’s business plans respecting the exploration and development of the Company’s mineral properties, the proposed work program on the Company’s mineral properties and the potential and economic viability of the Company’s mineral properties. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: changes in economic conditions or financial markets; increases in costs; litigation; legislative, environmental and other judicial, regulatory, political and competitive developments; and technological or operational difficulties. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

The CSE has not reviewed, approved or disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/180954