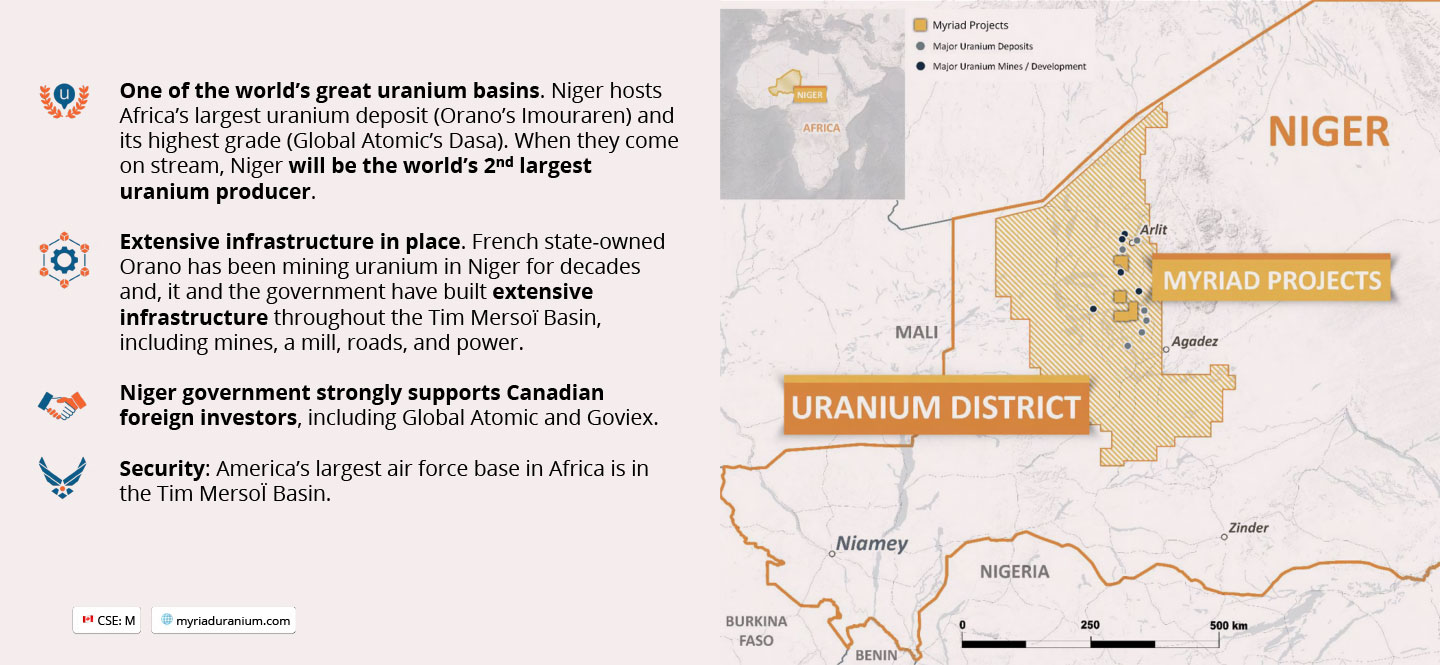

Uranium in the Tim Mersoï Basin, Niger

NOT YET APPLICABLE

Myriad Highlights

- 80% ownership over 1,800 km² in the Tim Mersoï Basin.

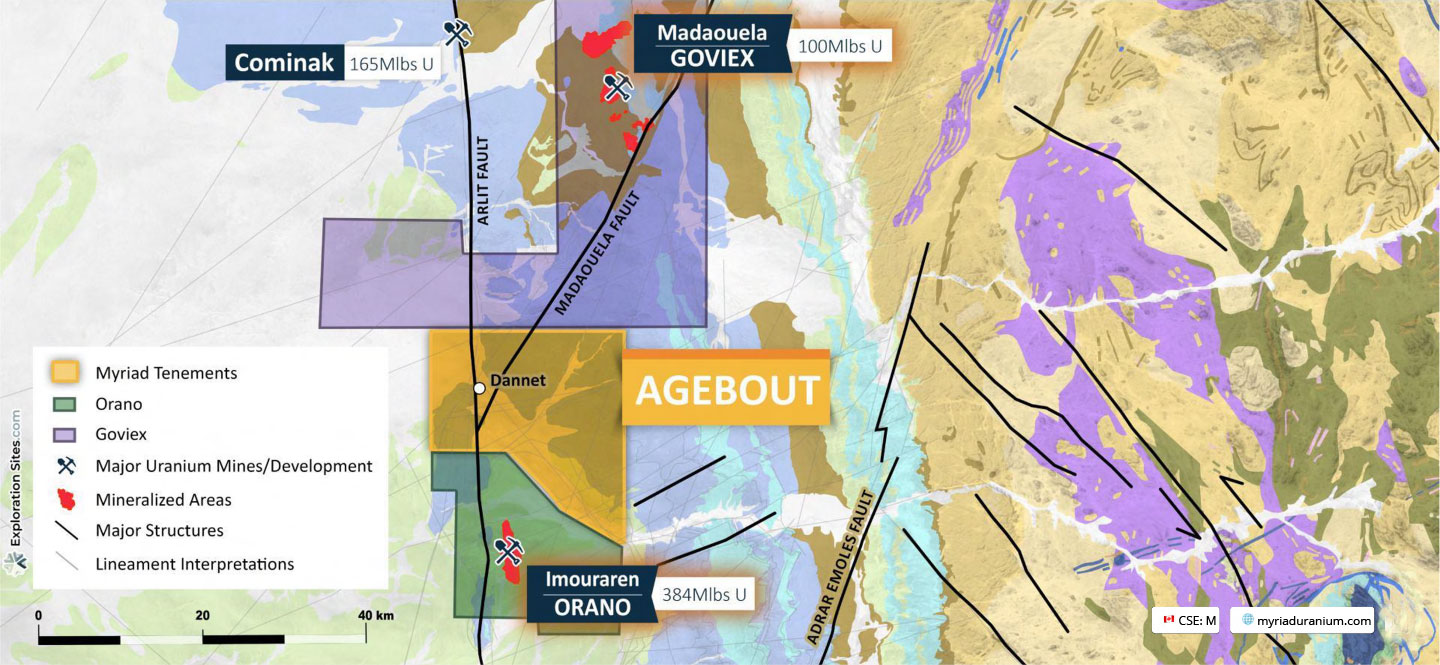

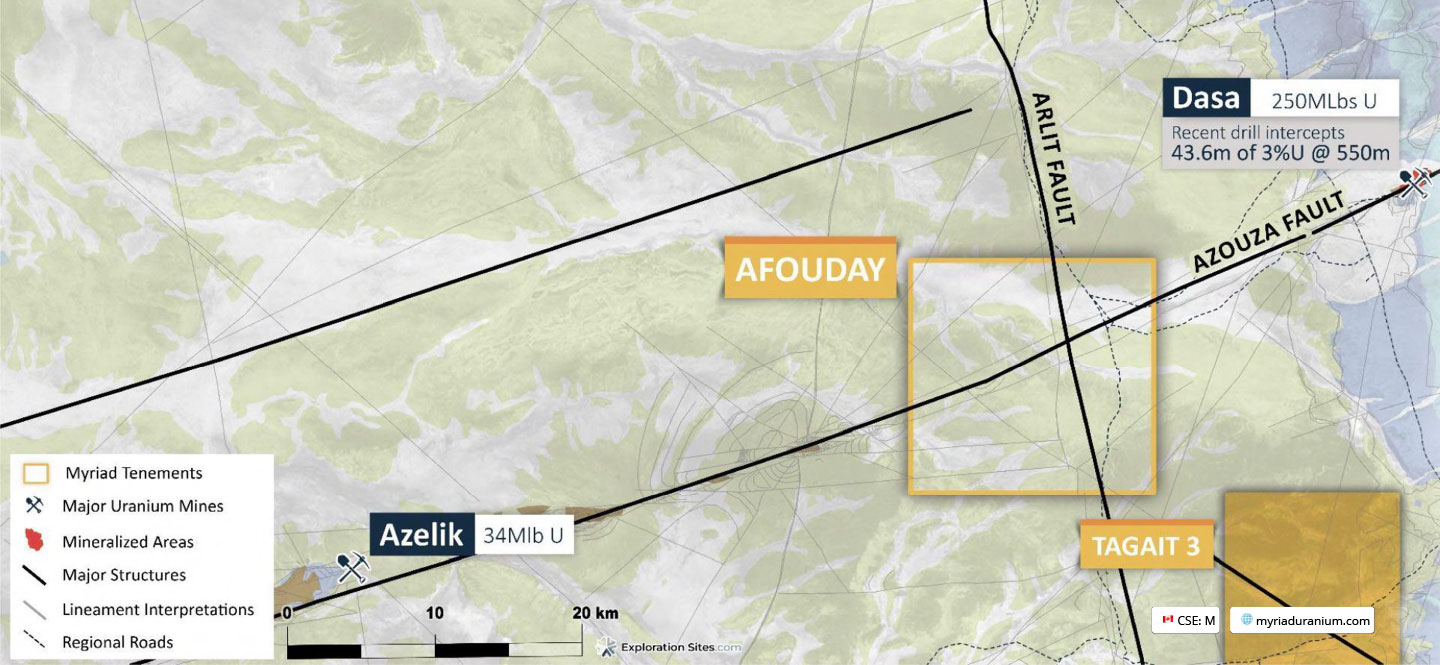

- Adjacent to Africa’s largest uranium deposit, Orano’s Imouraren (384 Mlbs eU₃O₈). $115M In-situ testing program underway.

- Adjacent to Africa’s highest grade development stage uranium deposit, Global Atomic’s Dasa (236 Mlbs eU₃O₈).

- Historic Areva data and plans worth millions of dollars.

- ~28.5m shares out, majority held by management and local partner and subject to 3 year escrow.

- Deep in-country relationships with government, private sector, Orano.

- Environmental and Social focus. We employ Canadian standards and global best practices. One of our Directors is a leader in environmental stewardship and social responsibility.

Historic Data + New Insights

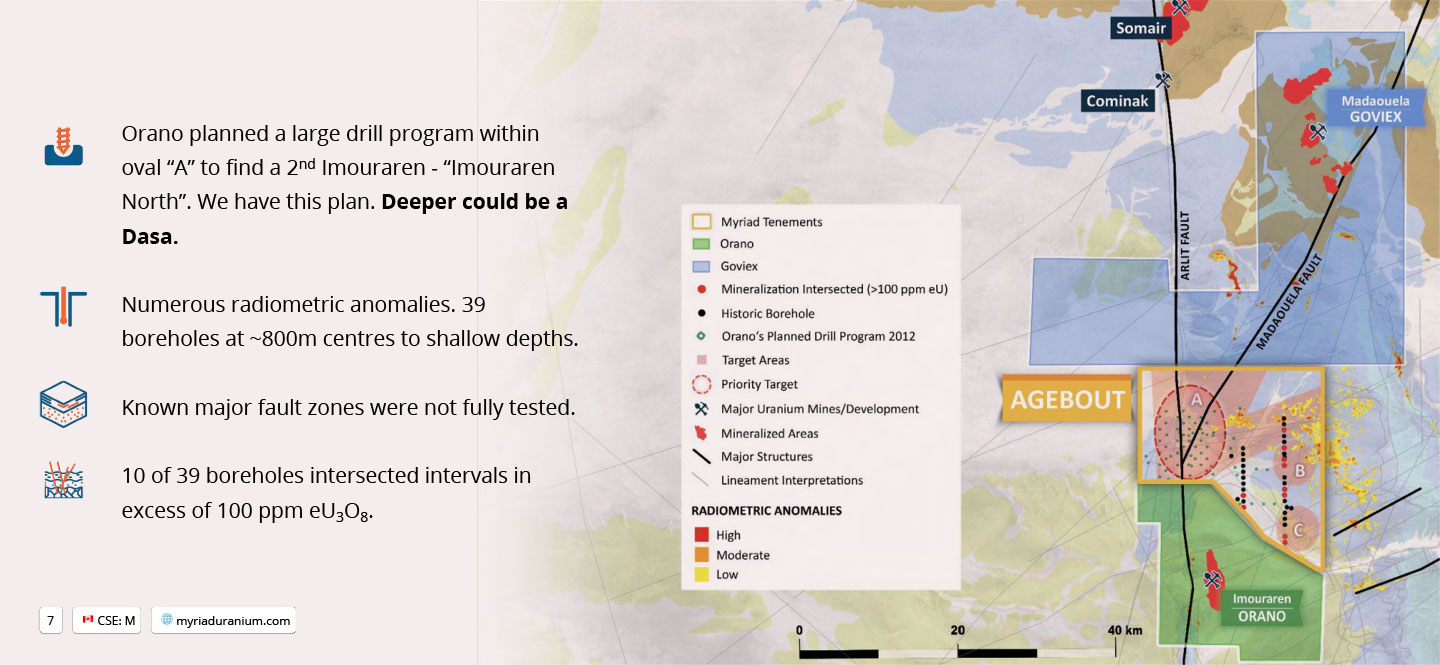

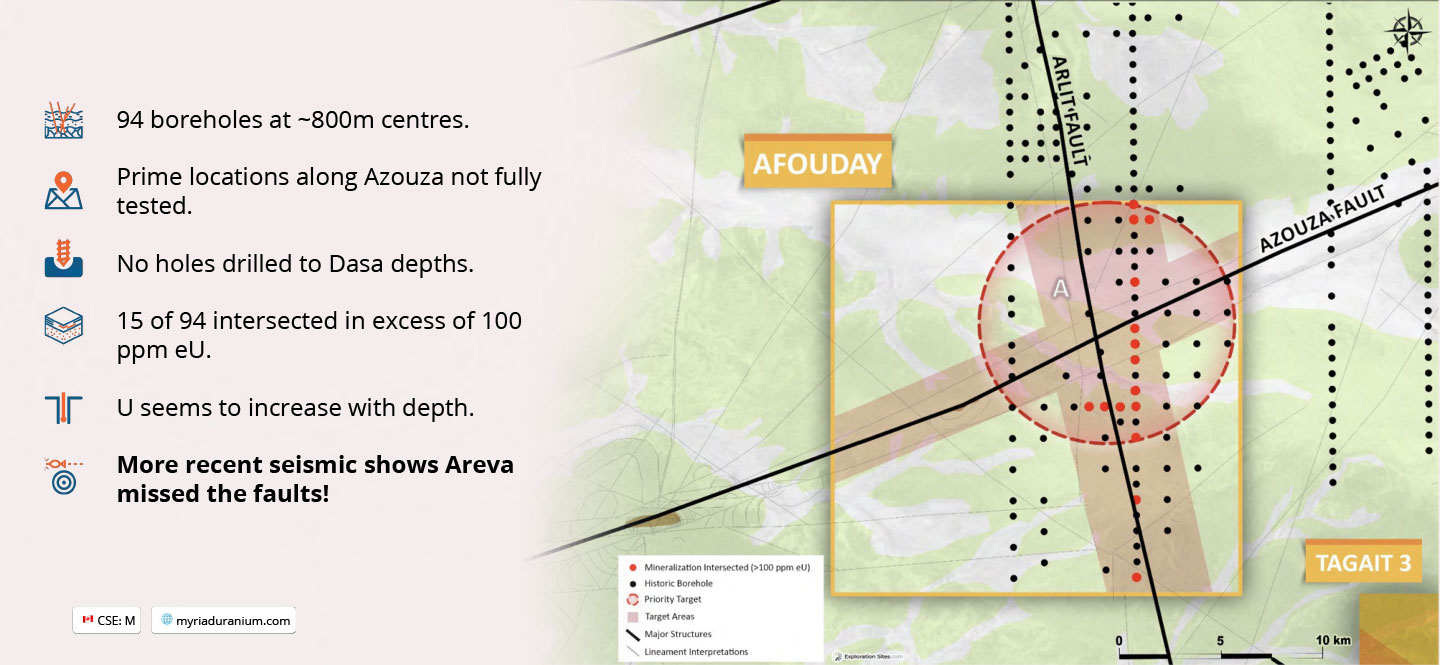

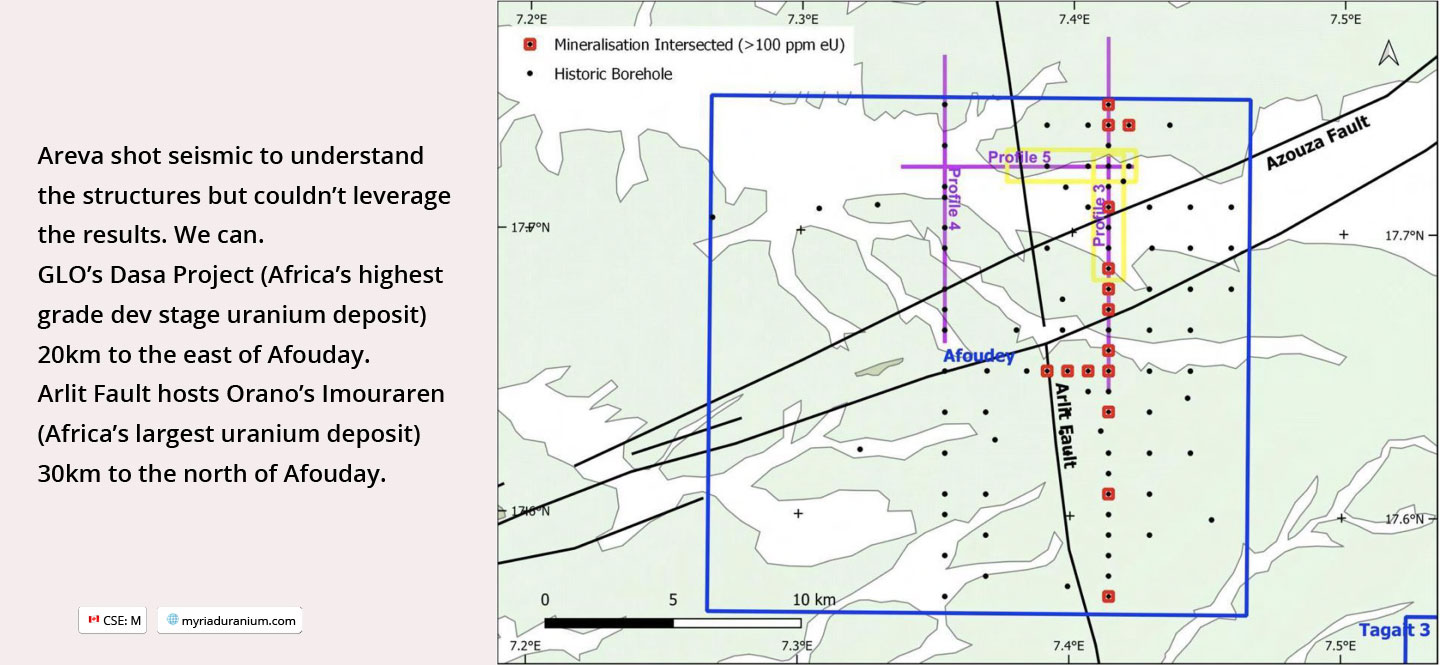

- Data worth millions. Orano (Areva) regional scale exploration included at least 161 boreholes (~24,000m), airborne and ground geophysics, geological mapping, and seismic surveys. We have this data.

- Plans. Orano planned intensive exploration in our areas, including into the deeper carboniferous taking into account Dasa insights. But didn’t get to it. We have those plans.

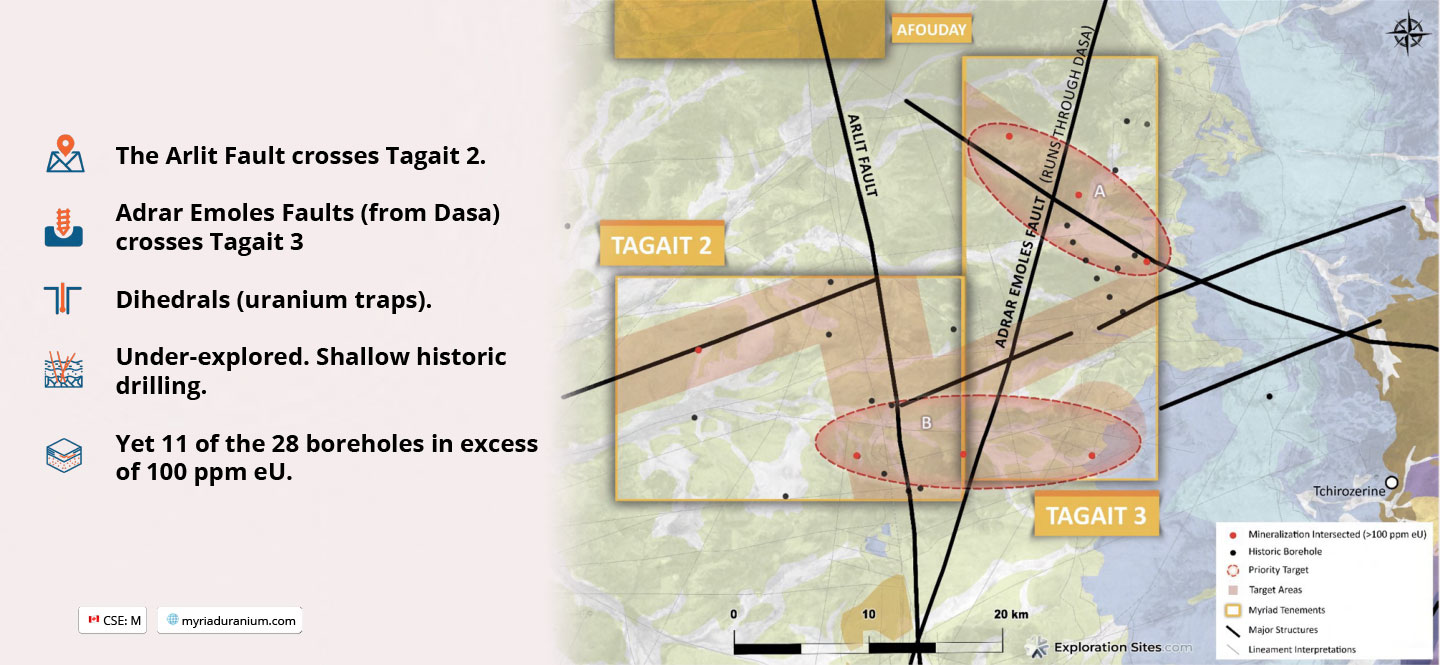

- We have uranium. Over 20% of historic boreholes within our licence areas intersected significant mineralization (over 100 ppm eU).

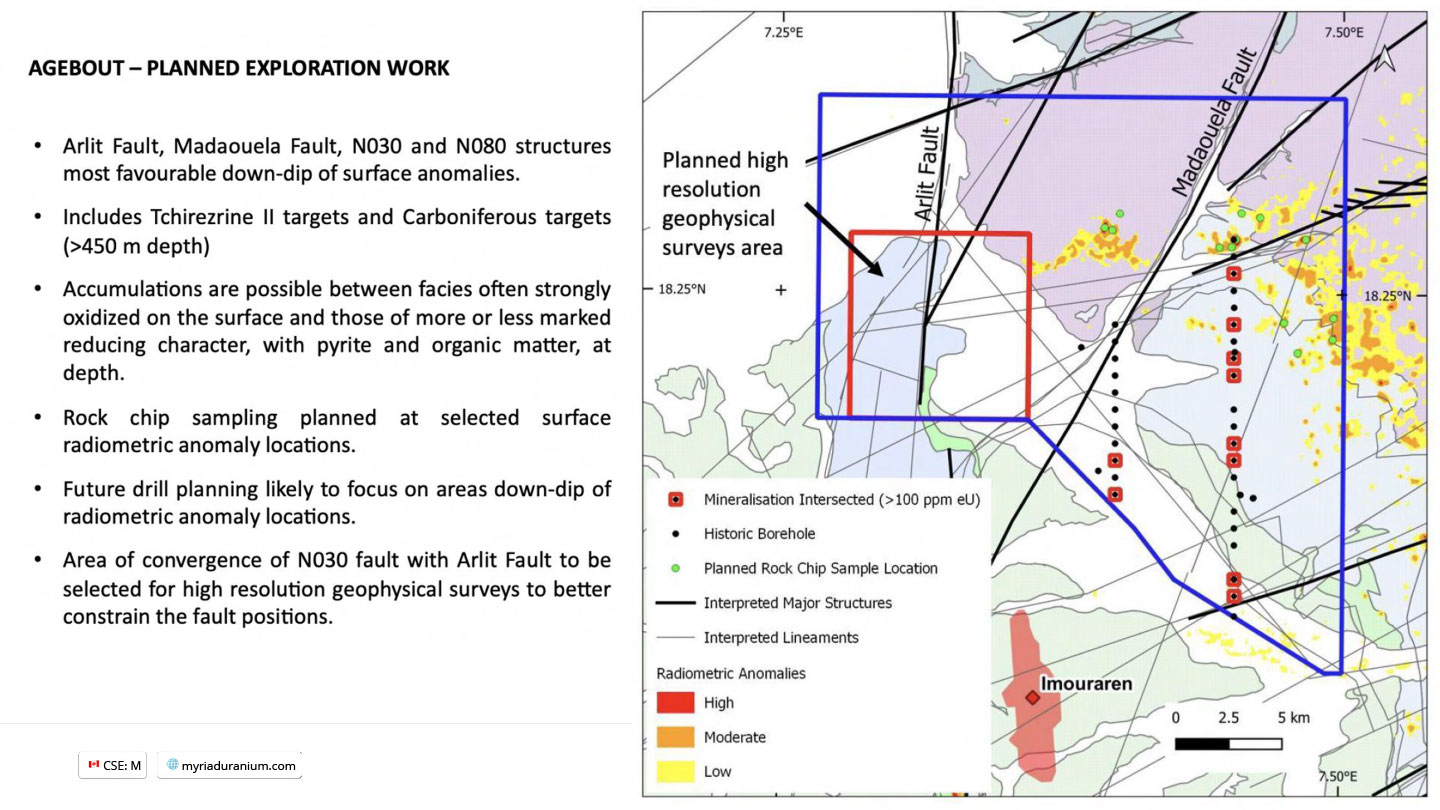

- Structural dihedrals. All Myriad licences show important structural dihedrals defined by the major faults that control uranium mineralization.

- Strong technical team. The Company has a world-class technical team led by George van der Walt and will now build on a wellspring of historical information, with a goal of drilling in 2023.

2023 Exploration Plan

Airborne and ground geophysics to aid targeting, then drilling.

- Historic data review completed.

- Field-based confirmation of surface anomalies underway.

- Ultra-high resolution drone mag survey and electrical method surface geophysics over key targets next to Imouraren and Dasa. Commencing June 2023.

- Identify and constrain target horizons and depths for drill targeting.

- Drilling 2H 2023.

Leadership

THOMAS LAMB

CEO and Board Member

Thomas Lamb is a graduate of London Business School, holding MSc, JD, and BA degrees. With 20 plus years of pubco experience, and many of those specific to exploration in Africa, he co-founded M2 Cobalt (sold to Jervois Global), Goldgroup, Rift Copper, and J2 Metals. He is a former Jervois executive, and speaks French, English and Russian.

GEORGE VAN DER WALT

Senior Geologist/ Qualified Person

George van der Walt is a Senior Economic Geologist with significant uranium experience. He managed the exploration and development of Peninsula’s vast Karoo uranium project in RSA. His experience includes exposure to Bushveld Complex PGE-Cu-Ni, lithium and rare metal pegmatites, and more. He currently serves as Head of Exploration Services at The MSA Group, a multinational consulting group with offices in South Africa, Egypt, Saudi Arabia and Kazakhstan.

NELSON LAMB

CFO

Mr. Nelson Lamb is a CPA, CA, experienced in corporate finance, financial reporting, and strategic planning. Mr. Lamb graduated from the Bachelor of Commerce program at the University of Victoria and obtained his CPA, CA designation while working at PricewaterhouseCoopers. From December 2015 to May 2021, Mr. Lamb worked as the Manager of Accounting Services at Pubco Reporting Solutions Inc., a boutique accounting and consulting firm.

Leadership

Loxcroft is a significant shareholder of Myriad and appoints two board members to Myriad’s board of directors.

DAYE KABA

Board Member

Daye Kaba is a partner at Asafo & Co., an Africa-based international law firm. Mr. Kaba previously worked as a partner at McCarthy Tetrault LLP and Fasken Martineau DuMoulin LLP in Toronto and Coudert Brothers LLP in Paris. He received his JD from the University of Michigan and is called to the New York bar and the Ontario bar. He is fluent in English, French and Portuguese.

CYRIL AMADI

Board Member

Cyril has 20 years’ experience in the mining industry as an engineer, banker and advisor. He has worked on debt advisory, technical risk analysis, modelling and structuring of mining finance transactions with leading institutions such as Endeavour Financial, WestLB and Unicredit. Cyril holds a Bachelor of Science degree in Engineering and an MBA from the Freiberg University of Mining in Germany.

LOXCROFT RESOURCES

Equity Partner

Loxcroft as an equity partner in Niger, Myriad gained (1) all of Loxcroft’s substantial local Niger knowledge and experience, (2) access to local exploration contractors, (3) influence within the Niger mining sector, and (4) access to new license areas if and when they become available in the future.

Leadership & Technical Committee

FRED BONNER

Board Member

Fred is a leader in environmental stewardship and socially responsible exploration. He is a P. Geo. (QP), a Fellow of Geoscientists Canada and a Fellow of the Society of Economic Geologists. He holds a BSc in Geology and Masters Degrees in Applied Science and Urban and Rural Planning. He has extensive experience in corporate governance, risk assessment and mitigation, working in communities.

DAVID MILLER

ISR/ISL Uranium Expert

David Miller is a professional economic geologist and previous Wyoming politician. Primarily focused in uranium exploration, development, and mining, his career has included senior roles at producers Utah International, Areva and Strathmore Minerals (where he was CEO). A recognized expert in the nuclear and energy fields, and in ISR/ISL extraction, he has been featured in the New York Times, BBC, CNBC, CNN, and more as a uranium expert.

RON HALAS

Technical Committee

Ron, a Canadian Mining Engineer, was most recently COO of Global Atomic Corp, where he advanced the Dasa deposit from PEA to mine development in 2.5 years. He has intimate knowledge of Dasa’s geology and extensive experience operating in the Tim Mersoï Basin. Ron was previously Operations Director and Acting GM at Kinross’ Tasiast gold mine in Mauritania, leading 3,000 employees and contractors.

Niger Technical Expertise

ADAMOU OUSEMANE

Technical Committee

M. Ousmane is Commander of the National Order of Merit of the Republic of Niger, one of Niger’s highest honours. A uranium geologist, he was previously Director General of Geology and Senior Advisor to the Minister of Mines. He has made significant contributions to the industrial heap leaching program of the COMINAK mine. He also led the IAEA’s NER 3002 project.

MICHAEL CANTEY

Technical Committee

Michael is a Principal Consultant & Geologist with over 18 years’ experience in exploration and development of mineral deposits across Africa. He has has coordinated projects from grassroots exploration to Bankable Feasibility Studies. He is a member of the Australian Institute of Geoscientists and the West African Institute of Mining, Metallurgy and Petroleum.

Niger Option Terms

- Myriad Uranium (CSE:M) issued 8.5m shares to optionor, Loxcroft Resources Ltd., and now owns 80% of the 4 licenses covering 1822 km².

- As of August 2023, Myriad owns 80% of the Niger projects and has until August 2028 to acquire the remaining 20% for $6m.

- Myriad may issue additional cash or shares to Loxcroft based on future positive, value-add milestones, such as definition of 10 Mlbs and 50 Mlbs eU3O8, PEA, grant of mining permit. Aggregate of potential bonuses is $5m.

- Loxcroft retains a 1% NSR.

Local Exploration Team

- Loxcroft is available to manage exploration in Niger, under the direction of Myriad’s board and an appointed Technical Committee.

- Loxcroft geologists have direct experience in the Tim Mersoï Basin, with most having previous experience with Orano, Goviex and Global Atomic.

- Early exploration has been highly efficient, with a great deal of emphasis on the compilation and analysis of previous work by Orano.

- Loxcroft has pre-existing business relationships with local drillers and other important service providers operating in the Tim Mersoï Basin.

- Strong and long-standing relationships with regulators and senior government officials.

Uranium for a Greener Planet

- United Nations has identified climate change as “the defining issue of our time”

- International efforts to increase wind and solar power have failed to displace fossil fuels

- Fossil fuels are now used to produce more electricity than ever before

- Nuclear power plants produce no greenhouse gas emissions

- Decarbonization will not be possible without an increased role for nuclear power

Global Uranium Supply & Demand

DEMAND

- Global increased awareness of nuclear power as a clean energy source

- Globally, 50+ reactors under construction, 100+ reactors planned, 300+ reactors proposed.

- WNA predicts a 27% increase in global demand over 2021-30, and a further 38% increase over 2031-40.

world-nuclear.org

SUPPLY

- Legacy mines closing – global uranium production decreased by ~20% between 2016 and 2020

- Global conflict/tension reducing supply from Russia, Ukraine, Kazakhstan, etc.

- At current uranium prices, exploitation of all but the most favourable deposits not feasible

Uranium Explorers in Niger

- Very successful uranium-focused Canadian public companies currently operate in Niger (see table to the right), in particular Global Atomic and Goviex.

- ASX-listed ENRG Elements is the most direct comparable, as an early-stage new entrant at roughly the same “exploration stage” as Myriad. It has a 10 Mlbs resource but less than half the land position of Myriad.

- TSX-listed Global Atomic, a direct neighbor to Myriad’s licenses, recently raised $50M CAD in equity.

| Company | Market Cap C$ |

|---|---|

| Orano | PRIVATE |

| Global Atomic (TSX) | 369.11M |

| Goviex (TSX) | 97.78M |

| ENRG Elements (ASX) | 3.68M |

| Myriad Uranium (CSE) | 4.56M |

*As of 2023/09/05

Myriad Structure

| Shares Issued & Outstanding | 34.0 M |

| Options | 3.8 M |

| Warrants | 9.4 M |

| Fully Diluted | 47.2 M |

*As of 2024/01/11

Review

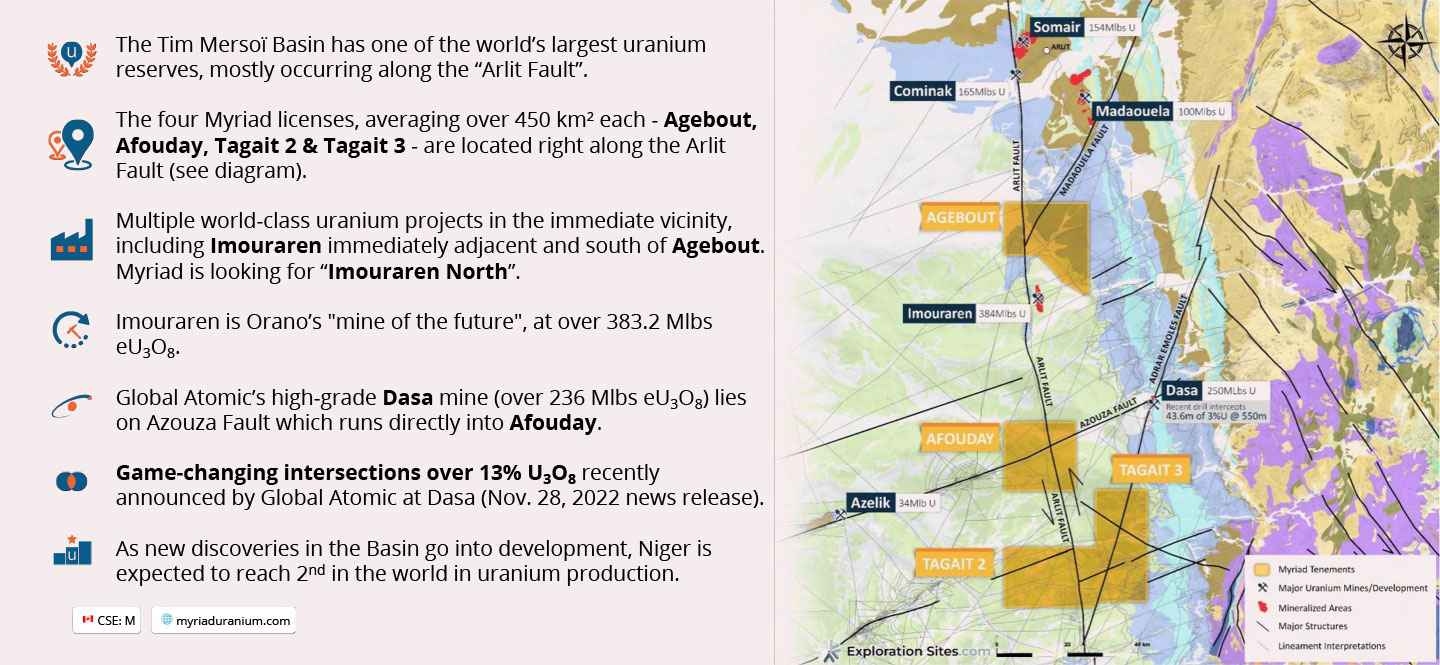

- Over 1800 km² of exploration licences in some of the most prospective uranium ground (the Tim Mersoï Basin), within one of the world’s leading uranium producing countries (Niger).

- Immediately adjacent to Imouraren, Africa’s largest uranium deposit.

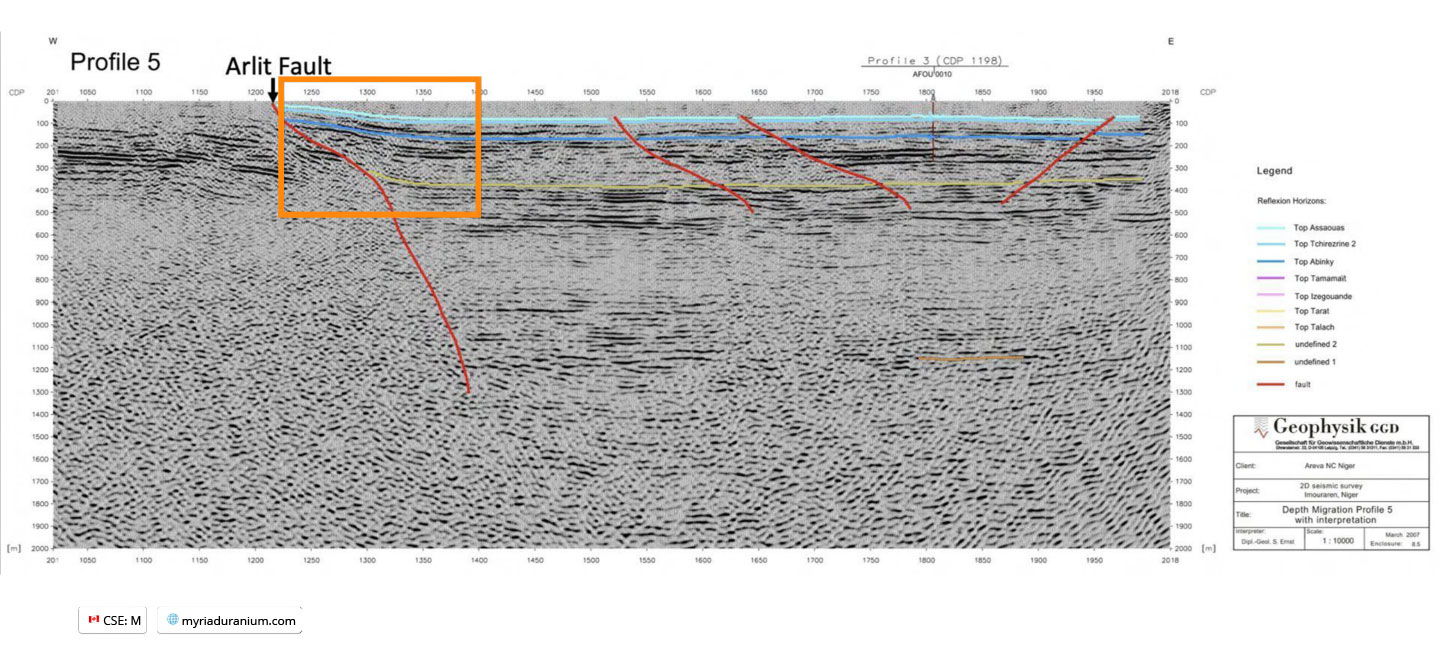

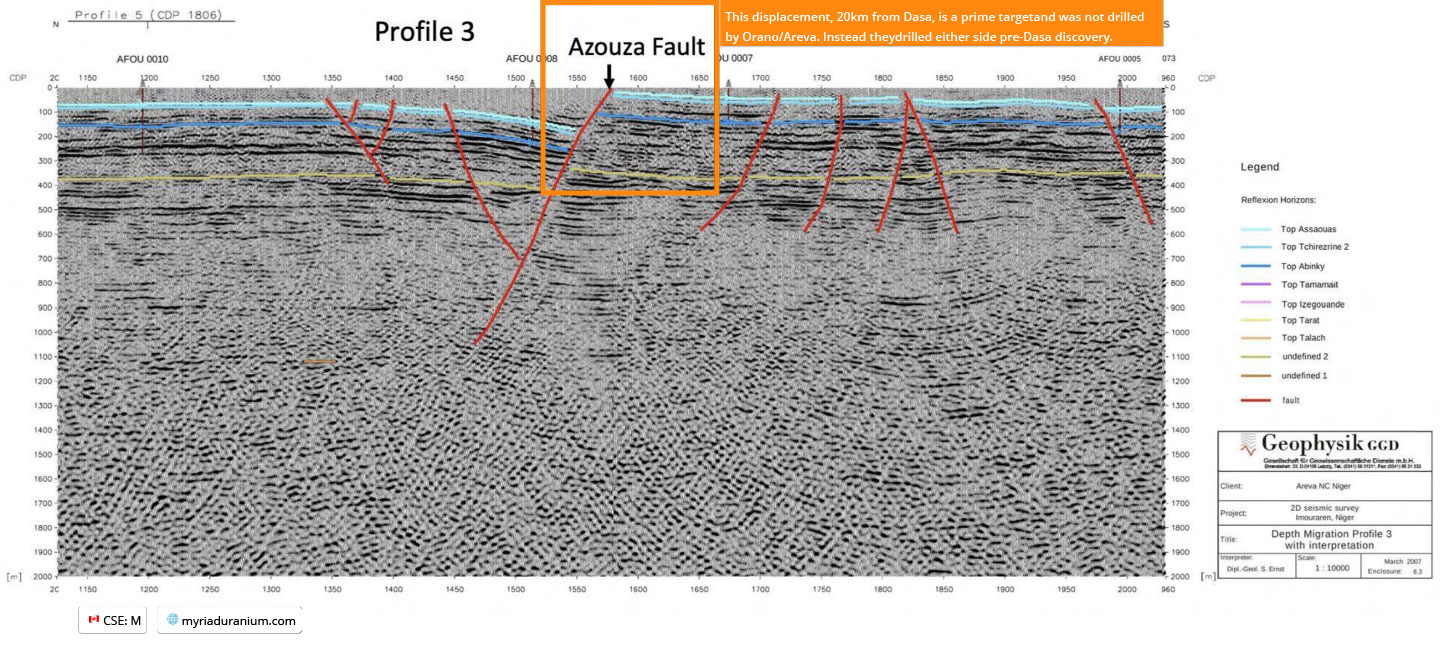

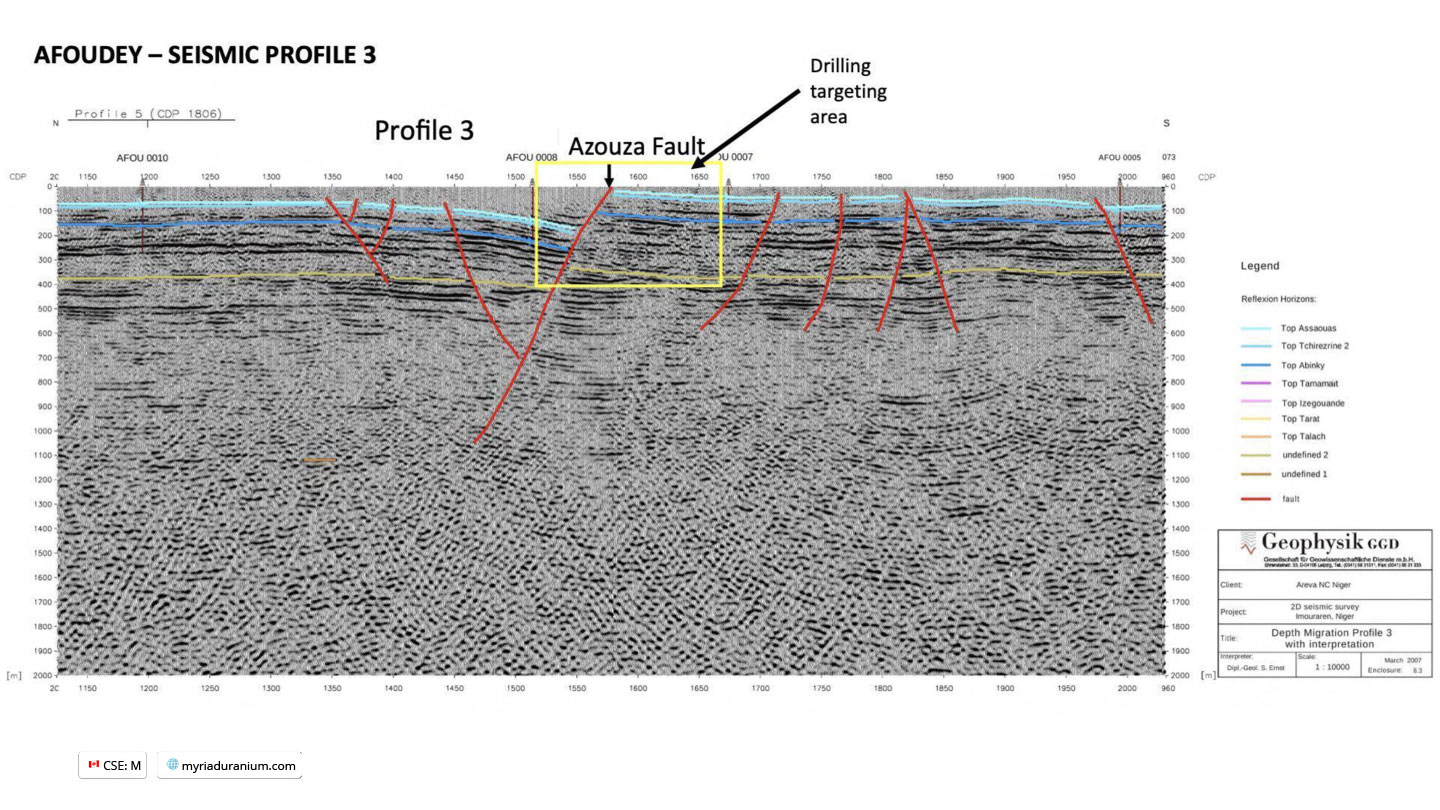

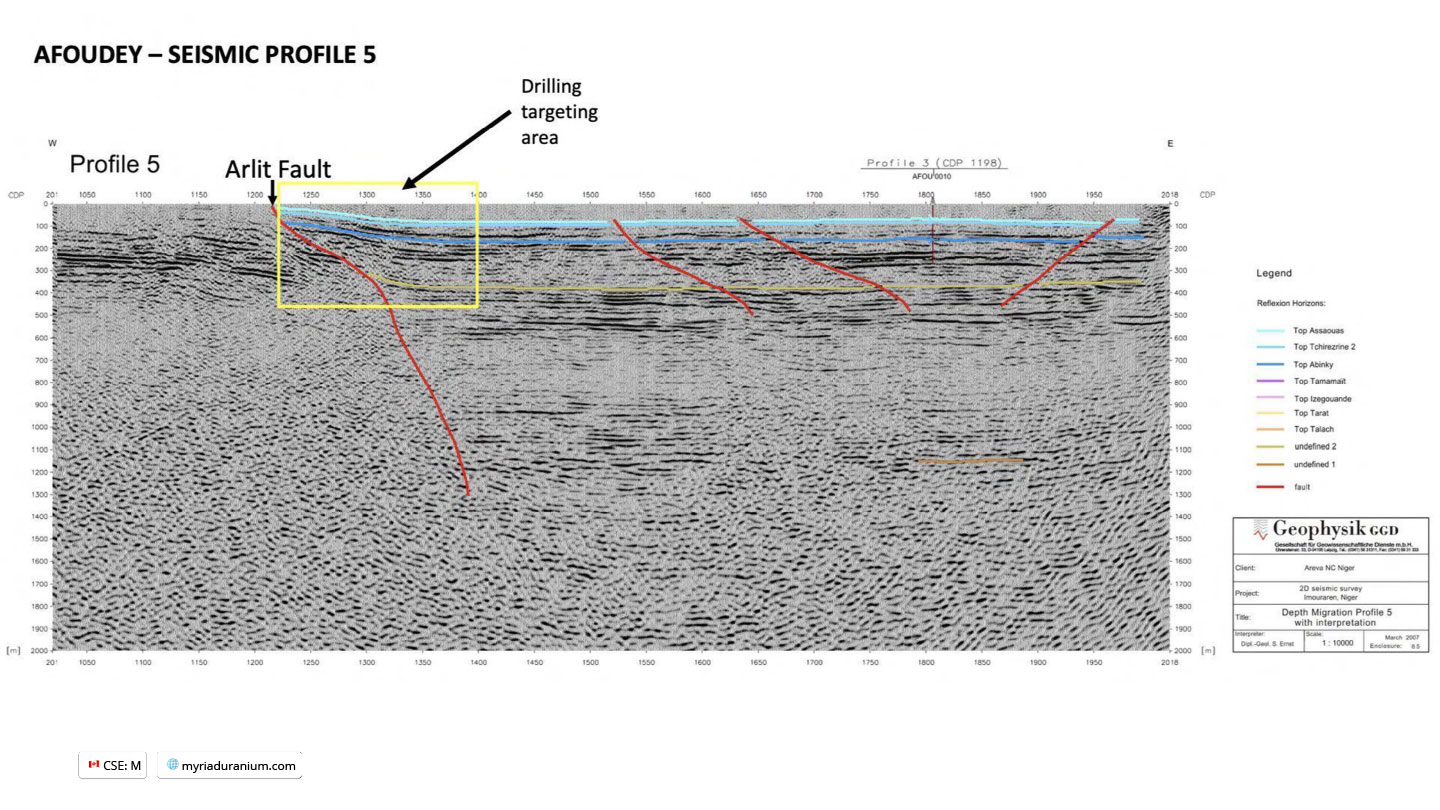

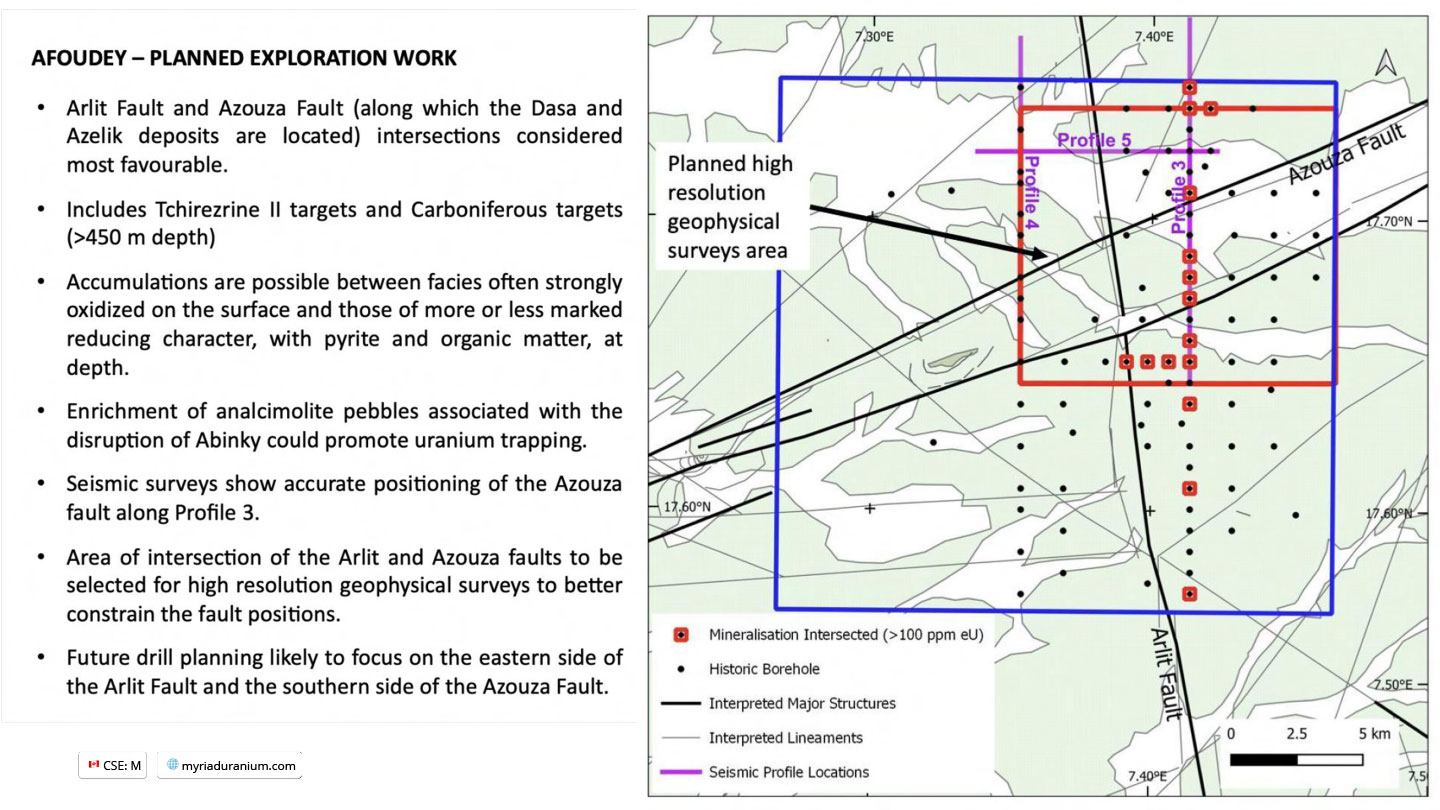

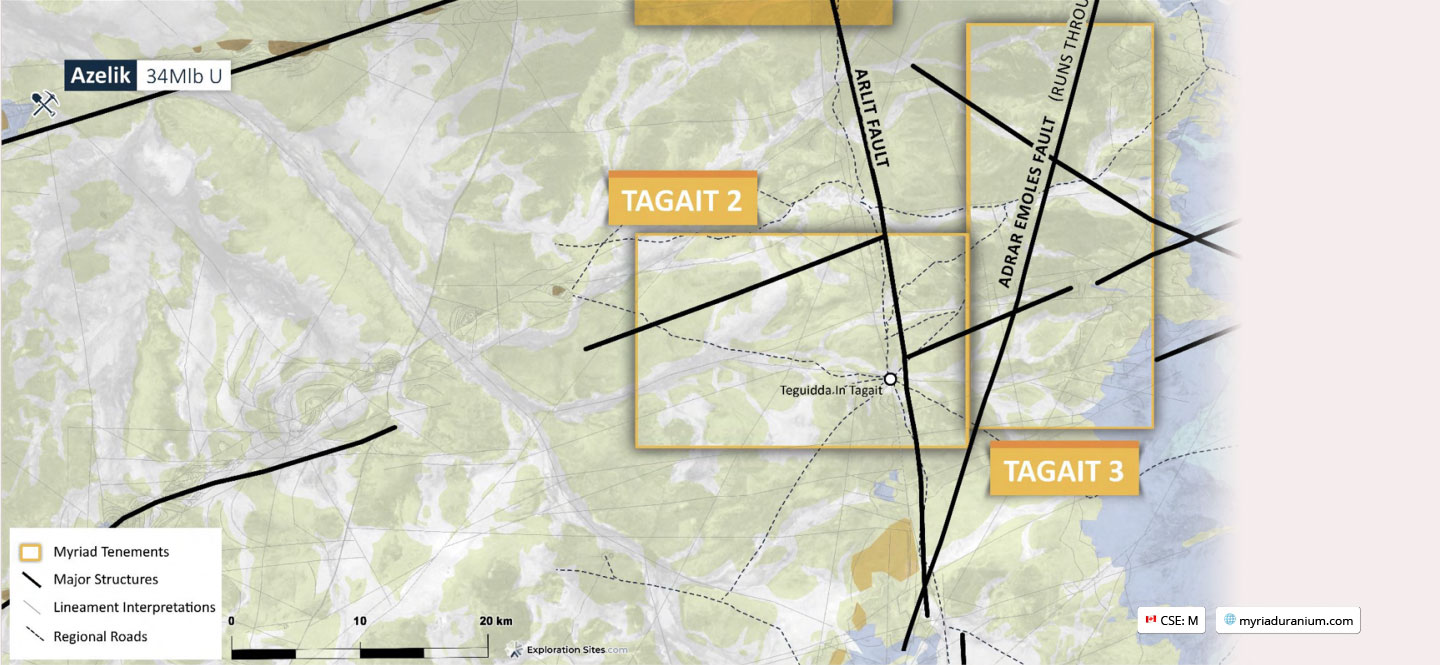

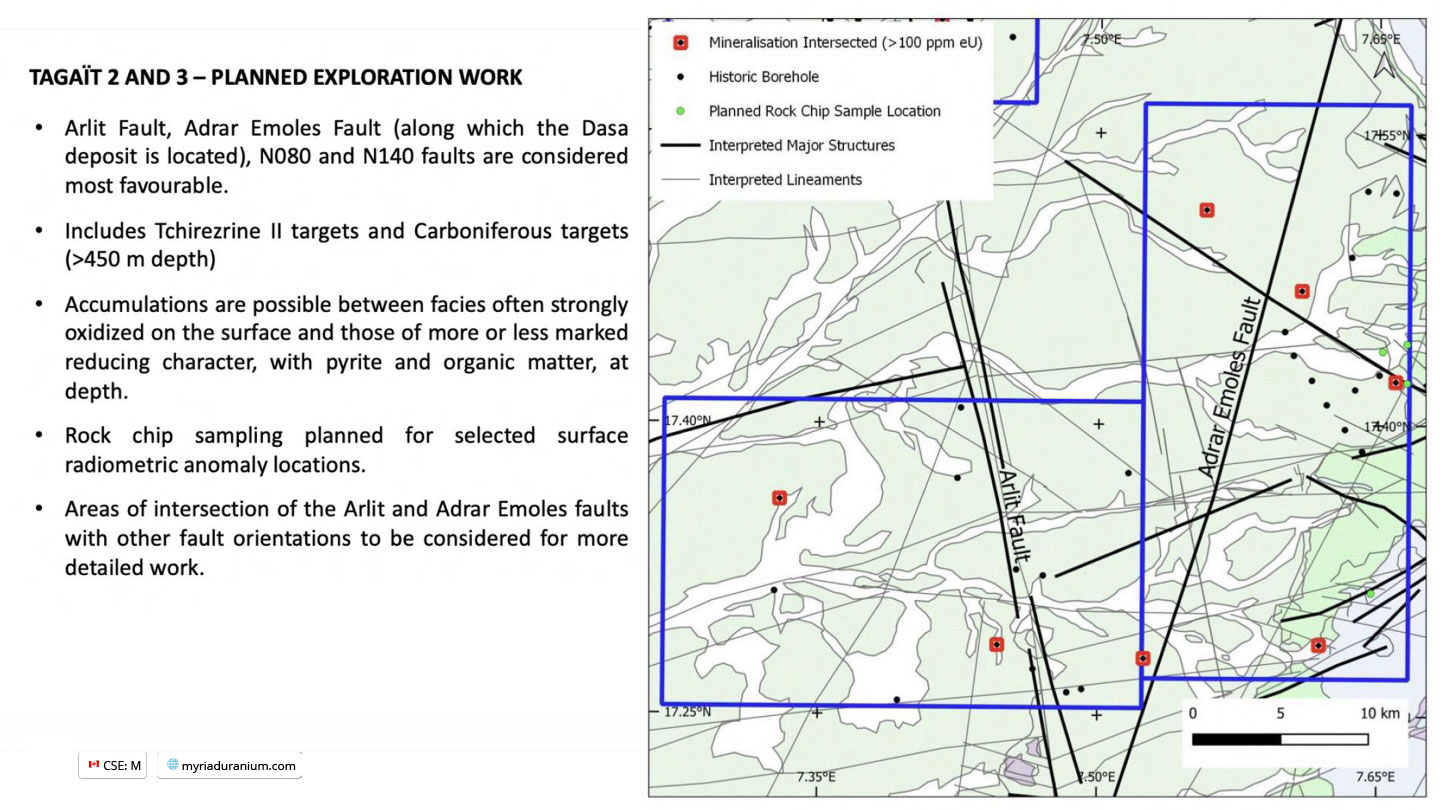

- The Azouza Fault which hosts Global Atomic’s high-grade Dasa mine, and the Arlit Fault which hosts Imouraren, intersect within Myriad’s license areas.

- Multiple other mines and deposits, such as China NNC’s Azelik and Goviex’s Madaouela, are within 50 kms of the Myriad license areas.

- Extensive historic data, giving Myriad a significant head start. A number of high-priority targets identified.

- Orano developed extensive plans to conduct intensive exploration within Myriad licences, but exited their exploration licences in the wake of Fukushima and was unable to initiate those plans.

- Board members and West African partners are Myriad’s largest shareholders – equity interests are aligned.

- Niger is a highly active uranium mining jurisdiction with deep expertise across the private sector and government.